All you need to know about the new income tax portal

The income tax portal is the essential part connecting the income tax department and taxpayers. There are several functionalities in the income tax portal other than e-filing income tax returns, like checking refund status queries, tracking notices served by the department, giving appropriate responses to notices, and some other functions. To the comfortability of the taxpayers, several new features are added to the income tax portal which can support the easy tax payment and further interactions. Let's understand more about the new income tax portal and about how to register in that.

The income tax portal is the essential part connecting the income tax department and taxpayers. There are several functionalities in the income tax portal other than e-filing income tax returns, like checking refund status queries, tracking notices served by the department, giving appropriate responses to notices, and some other functions. To the comfortability of the taxpayers, several new features are added to the income tax portal which can support the easy tax payment and further interactions. Let's understand more about the new income tax portal and about how to register in that.

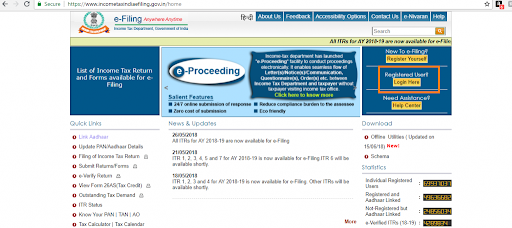

About new income tax portal

|

The income tax department has launched the new income tax portal to ensure that the taxpayers are conveniently experiencing the tax payment process by incorporating modern features. This new portal has improved the user experience and interactions of the taxpayer. The users can migrate and transition from the old income tax portal to the new portal to make the features available. The tax returns are processed faster, and several developments are introduced in the new income tax portal. There were some glitches in the initial stages of the new portal, and stakeholders were not able to perform certain compliance functions within the time limit. But this will be resolved soon by the service provider so that the taxpayers can utilize the portal effectively. This e-filing portal is mainly used by the taxpayers to file their ITR, request refunds, and also raise complaints. The income tax department can use the new income tax portal to get a response from the taxpayers regarding any queries. With this new income tax portal, the taxpayer can file ITR and complete other tasks without hassle in a comfortable manner.

Advantages of the new tax portal:

-

The new income tax portal is user-friendly, the processing of income tax returns filed by the taxpayer is quicker. The taxpayer can get the refunds without waiting much as the income tax returns are processed fast.

-

You know that now there are ITR1 and ITR4 software is available online and offline. ITR2 software is available online, taxpayers will have the benefit from free ITR preparation software. ITR3, ITR4, ITR5, ITR6, and ITR7 preparation software will be available soon for the taxpayers. For the convenience of the users, there are interactive questions in the software which will help you throughout the e-filing process.

-

'New call centre' service is integrated with the new income tax portal so that the taxpayers can get immediate responses to their queries. It also has FAQs, tutorials, chatbots, and videos for assisting the taxpayers throughout the process.

-

There is a single dashboard for the taxpayer to view the interactions, uploads, and any pending actions in the income tax portal.

-

There are multiple payment options for the taxpayers in the new portal. Credit cards, UPI, net banking, and RTGS/ NEFT are the payment options included for the taxpayer.

-

The functions of the new portal will be launched as a mobile application, so the taxpayer can easily access the portal at any time through the mobile network.

-

The taxpayer can prefill some of the details regarding certain incomes in the new portal. You can also prefill the data like salary income, dividend, capital gains, and interest. This prefiling is possible when the entities upload the TDS and SFT statements.

Already existing features:

-

The taxpayer can link Aadhaar and PAN through the existing portal. Filing of ITR types and responses to the e-proceedings is possible.

-

You can change ITR particulars by requesting online, also grievances can be lodged.

-

The intimation’s requesting feature is present in the old portal.

-

Requests for reissuing refunds, and audit reports filing are possible.

-

You can view the tax credit if there is any mismatch.

-

The taxpayer can view their tax credit statement (26AS).

-

You can verify the ITR filing procedure online.

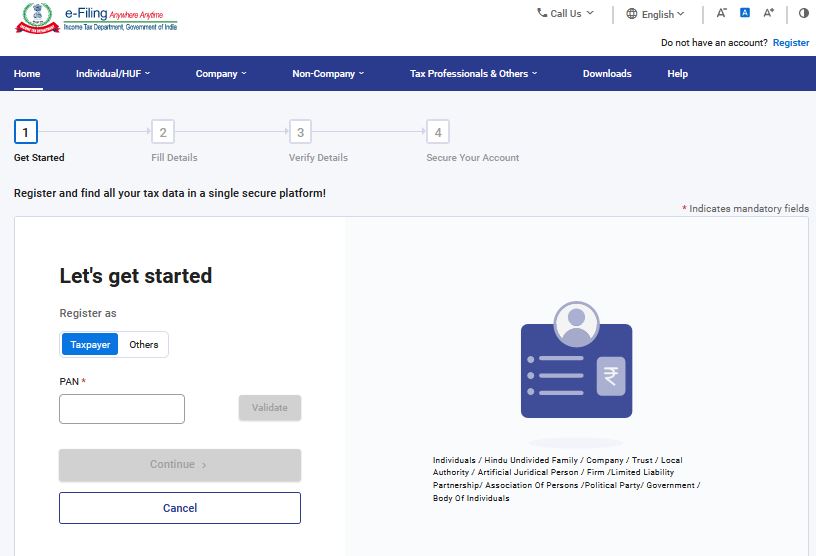

How to register in the new portal?

|

If you are planning to file for your income tax returns through the newly launched income tax portal, they need an account in the portal. The new taxpayers, before filing the tax returns, should register themselves in the new income tax portal. The user needs to provide a valid PAN, mobile number, and email id for the registration process. An error message will pop up if your PAN is already registered or inactive. The taxpayer requires to type a personalized message that can be up to 25 characters, whenever you log in to your account, you can see this personalized message.

-

For registering in the new income tax portal, the taxpayer should visit www.incometax.gov.in.

-

You need to click on the register option and choose taxpayer in the category.

-

The taxpayer should enter a valid PAN and click on the validate option. The error message is shown if the PAN is already registered or inactive. You should confirm as an individual taxpayer, once your PAN is validated you can continue further procedures.

-

Now you should enter the basic details, including your last name, first name, middle name, gender, date of birth, and whether you are a resident/ non-resident.

-

Then you need to enter the primary mobile number and email id, and you should also select whether the contact details belong to you or someone else. You can also enter the valid communication address in the portal.

-

You will receive separate one-time passwords (OTPs) in the mobile number and email id which will be valid only for fifteen minutes. Make sure that you enter OTPs quickly and continue to further process to avoid lag.

-

The taxpayer should verify all the details provided in the previous steps, and then you can edit the details in the last step of registration. If you have completed the verification procedure, you can click on confirm button.

-

You can enter the desired password and re-enter the same for confirmation in the portal. (Make sure that your password has characters between 8 and 14, which is a mix of uppercase, lowercase, one special character, and one number).

|

About new income tax portal

The income tax department has launched the new income tax portal to ensure that the taxpayers are conveniently experiencing the tax payment process by incorporating modern features. This new portal has improved the user experience and interactions of the taxpayer. The users can migrate and transition from the old income tax portal to the new portal to make the features available. The tax returns are processed faster, and several developments are introduced in the new income tax portal. There were some glitches in the initial stages of the new portal, and stakeholders were not able to perform certain compliance functions within the time limit. But this will be resolved soon by the service provider so that the taxpayers can utilize the portal effectively. This e-filing portal is mainly used by the taxpayers to file their ITR, request refunds, and also raise complaints. The income tax department can use the new income tax portal to get a response from the taxpayers regarding any queries. With this new income tax portal, the taxpayer can file ITR and complete other tasks without hassle in a comfortable manner.

Advantages of the new tax portal:

-

The new income tax portal is user-friendly, the processing of income tax returns filed by the taxpayer is quicker. The taxpayer can get the refunds without waiting much as the income tax returns are processed fast.

-

You know that now there are ITR1 and ITR4 software is available online and offline. ITR2 software is available online, taxpayers will have the benefit from free ITR preparation software. ITR3, ITR4, ITR5, ITR6, and ITR7 preparation software will be available soon for the taxpayers. For the convenience of the users, there are interactive questions in the software which will help you throughout the e-filing process.

-

'New call centre' service is integrated with the new income tax portal so that the taxpayers can get immediate responses to their queries. It also has FAQs, tutorials, chatbots, and videos for assisting the taxpayers throughout the process.

-

There is a single dashboard for the taxpayer to view the interactions, uploads, and any pending actions in the income tax portal.

-

There are multiple payment options for the taxpayers in the new portal. Credit cards, UPI, net banking, and RTGS/ NEFT are the payment options included for the taxpayer.

-

The functions of the new portal will be launched as a mobile application, so the taxpayer can easily access the portal at any time through the mobile network.

-

The taxpayer can prefill some of the details regarding certain incomes in the new portal. You can also prefill the data like salary income, dividend, capital gains, and interest. This prefiling is possible when the entities upload the TDS and SFT statements.

Already existing features:

-

The taxpayer can link Aadhaar and PAN through the existing portal. Filing of ITR types and responses to the e-proceedings is possible.

-

You can change ITR particulars by requesting online, also grievances can be lodged.

-

The intimation’s requesting feature is present in the old portal.

-

Requests for reissuing refunds, and audit reports filing are possible.

-

You can view the tax credit if there is any mismatch.

-

The taxpayer can view their tax credit statement (26AS).

-

You can verify the ITR filing procedure online.

How to register in the new portal?

If you are planning to file for your income tax returns through the newly launched income tax portal, they need an account in the portal. The new taxpayers, before filing the tax returns, should register themselves in the new income tax portal. The user needs to provide a valid PAN, mobile number, and email id for the registration process. An error message will pop up if your PAN is already registered or inactive. The taxpayer requires to type a personalized message that can be up to 25 characters, whenever you log in to your account, you can see this personalized message.

-

For registering in the new income tax portal, the taxpayer should visit www.incometax.gov.in.

-

You need to click on the register option and choose taxpayer in the category.

-

The taxpayer should enter a valid PAN and click on the validate option. The error message is shown if the PAN is already registered or inactive. You should confirm as an individual taxpayer, once your PAN is validated you can continue further procedures.

-

Now you should enter the basic details, including your last name, first name, middle name, gender, date of birth, and whether you are a resident/ non-resident.

-

Then you need to enter the primary mobile number and email id, and you should also select whether the contact details belong to you or someone else. You can also enter the valid communication address in the portal.

-

You will receive separate one-time passwords (OTPs) in the mobile number and email id which will be valid only for fifteen minutes. Make sure that you enter OTPs quickly and continue to further process to avoid lag.

-

The taxpayer should verify all the details provided in the previous steps, and then you can edit the details in the last step of registration. If you have completed the verification procedure, you can click on confirm button.

-

You can enter the desired password and re-enter the same for confirmation in the portal. (Make sure that your password has characters between 8 and 14, which is a mix of uppercase, lowercase, one special character, and one number).